First Time Home Buyer 401k Withdrawal 2024 Limits – For many of our clients, the number one savings goal (apart from saving for retirement) is buying their first home. If your client is considering purchasing their first home at some point in 2024, . These limits fluctuate to keep up with inflation, though they may not change from year to year. The 401(k) and IRA contribution maximums did increase for 2024, however, which means Americans can .

First Time Home Buyer 401k Withdrawal 2024 Limits

Source : www.fool.comSave More in Your 401(k) or IRA in 2024: IRS Announces New

Source : smartasset.com401k Contribution Limits For 2023

Source : thecollegeinvestor.comWhat’s New for Retirement Saving for 2024? | SEIA | Signature

Source : www.seia.com401(k) Contribution Limits In 2023 And 2024 | Bankrate

Source : www.bankrate.comNew 401(k) and IRA Contribution Limits for 2024 Articles

Source : www.consumerscu.orgRoth IRA: Benefits, Rules, and Contribution Limits 2024

Source : districtcapitalmanagement.comChanges to 401(k) plans in 2024 | CNN Underscored Money

Source : www.cnn.comNew 401(k) Contribution Limits for 2024 | 401ks | U.S. News

Source : money.usnews.comIRA Contribution Limits And Income Limits For 2023 And 2024

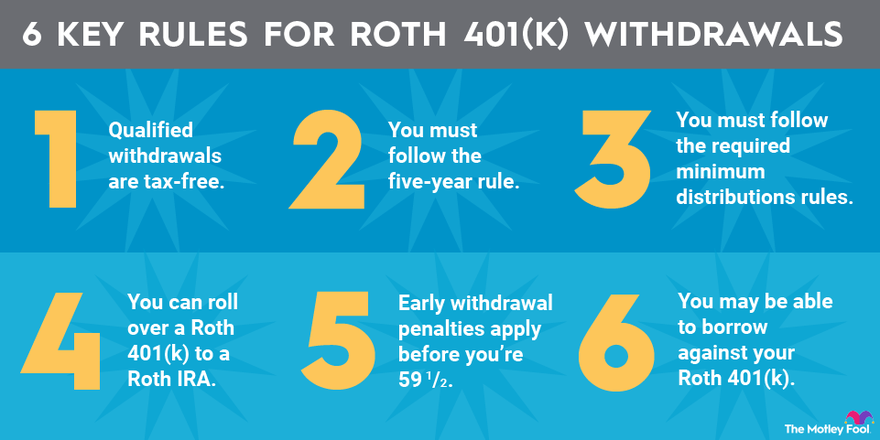

Source : thecollegeinvestor.comFirst Time Home Buyer 401k Withdrawal 2024 Limits 6 Things to Know About Roth 401(k) Withdrawals | The Motley Fool: Compared to a 401(k), IRAs have relatively low contribution limits. The most you can contribute to an IRA in 2024 first-time homebuyers can withdraw up to $10,000 to put toward the home . You can only put so much in your IRAs each year. Plus, the amount you can put in a Roth IRA each year can also be reduced (potentially to zero) if your income is above a certain amount. However, the .

]]>