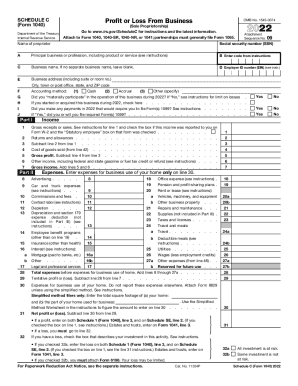

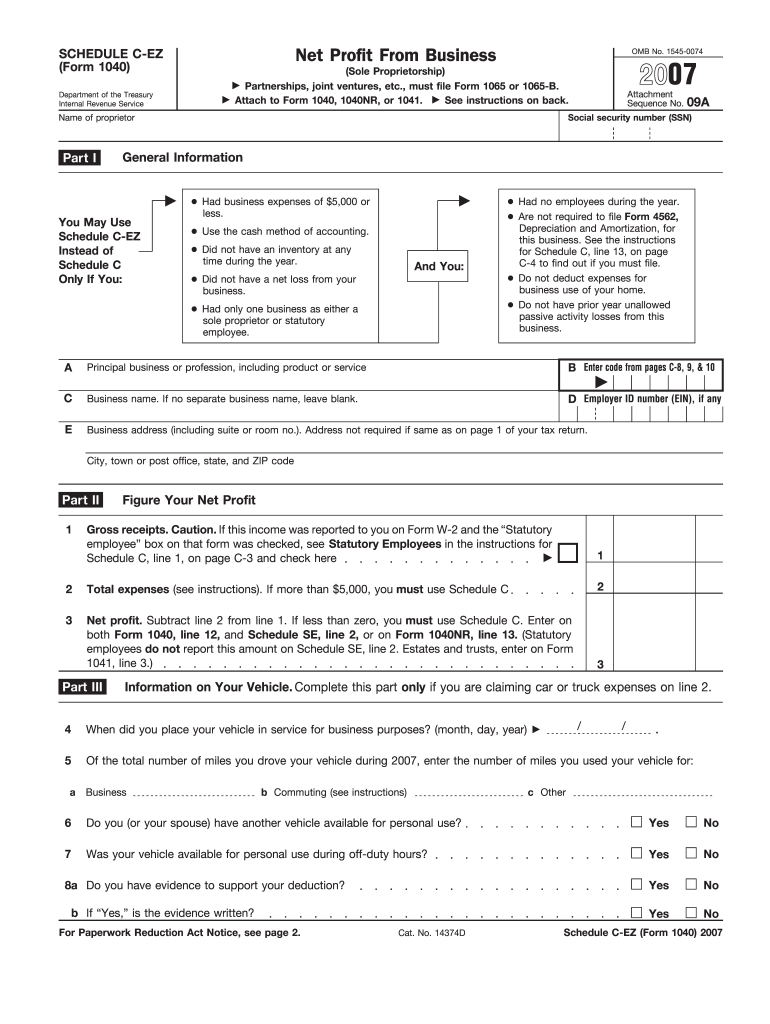

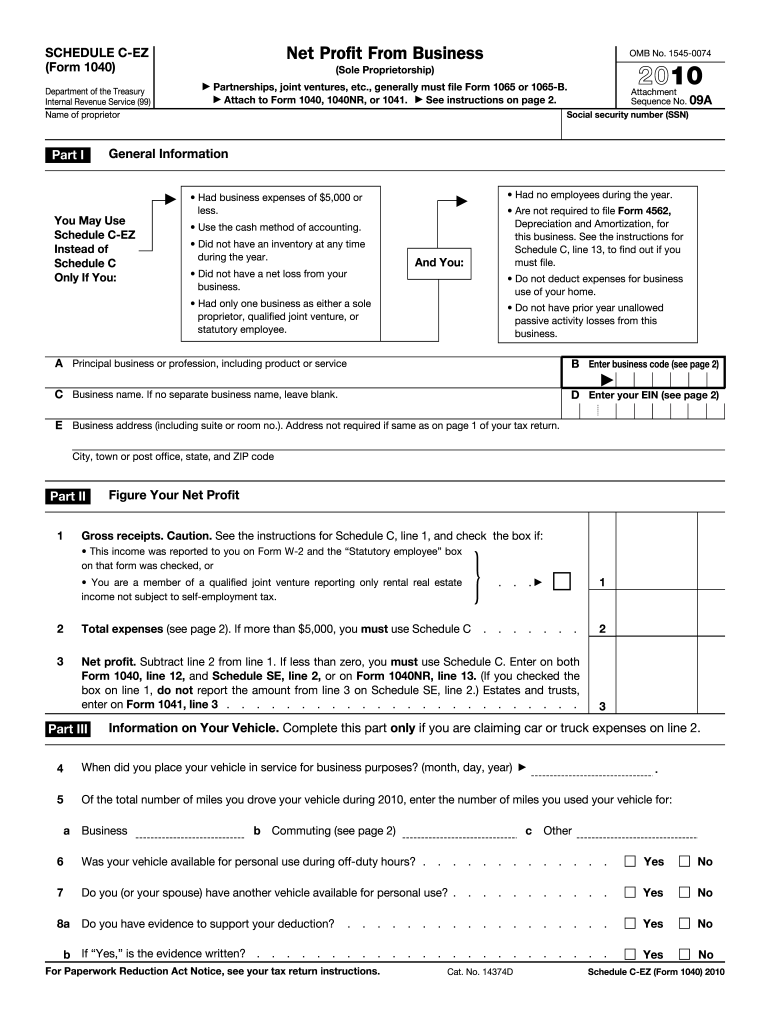

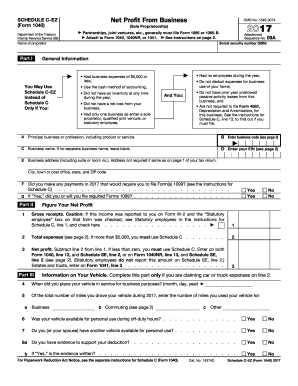

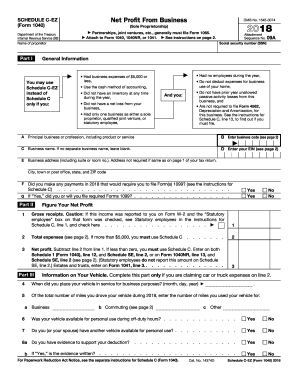

2024 1040 Schedule C-Ez – By subtracting all expenses from revenue, you’ll arrive at your net profit, which is reported on the “Business income or (loss)” line of your 1040. The Schedule C-EZ is a shorter and simpler . Sole proprietors may only need the form 1040, Schedule SE for self employment taxes, and Schedule C-EZ for reporting the year’s business profits. Larger businesses with employees, limited .

2024 1040 Schedule C-Ez

Source : irs-schedule-c-ez.pdffiller.comF1204 Form 1040 Schedule F Profit or Loss from Farming (Page 1

Source : www.nelcosolutions.com2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.comWhat Is Schedule D: Capital Gains and Losses?

Source : www.investopedia.comIRS 1040 Schedule C 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comTaxes Schedule C Form 1040 (2023 2024) | PDFliner

Source : pdfliner.comSchedule c ez: Fill out & sign online | DocHub

Source : www.dochub.comRFE I 485 / I 865: Sponsor doesn’t meet requirements? : r/USCIS

Source : www.reddit.comSchedule c ez: Fill out & sign online | DocHub

Source : www.dochub.comSchedule C EZ Form Fill Out and Sign Printable PDF Template

Source : www.signnow.com2024 1040 Schedule C-Ez 2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable : Are there ways to reduce this tax burden? Here’s what you need to know. Schedule C (1040) is an IRS tax form for reporting business-related income and expenses. Its official name is Profit or Loss . or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 Line 1 as employment wages. The IRS ruled that cryptocurrencies are “property” in IRS Notice 2014-21 .

]]>

:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-bce9771cbe94498ab34d6b9107e208de.png)